candlestick patterns that all traders ought to be aware of

The direction of price movement in the future can be predicted using candlestick patterns. Learn how to use the most popular candlestick patterns to spot trading opportunities.

What is a candlestick?

A candlestick can be used to show data regarding the price movement of an item. One of the most often used elements of technical analysis are candlestick charts, which allow traders to rapidly and from a small number of price bars understand price information.

Hammer

The hammer candlestick pattern, which appears at the bottom of a downward trend, is made up of a short body and a long lower wick. A hammer indicates that even though there were selling forces during the day, the price eventually rose due to significant purchasing pressure. Although the body color may differ, green hammers are more indicative of a robust bull market than red hammers.

Inverse Hammer

The inverted hammer is another bullish pattern. The upper wick is longer than the bottom wick; that's the only distinction. It suggests that there was first buying demand and then weak selling pressure that did not cause the market price to drop. The inverse hammer implies that buyers will take command of the market in the near future.

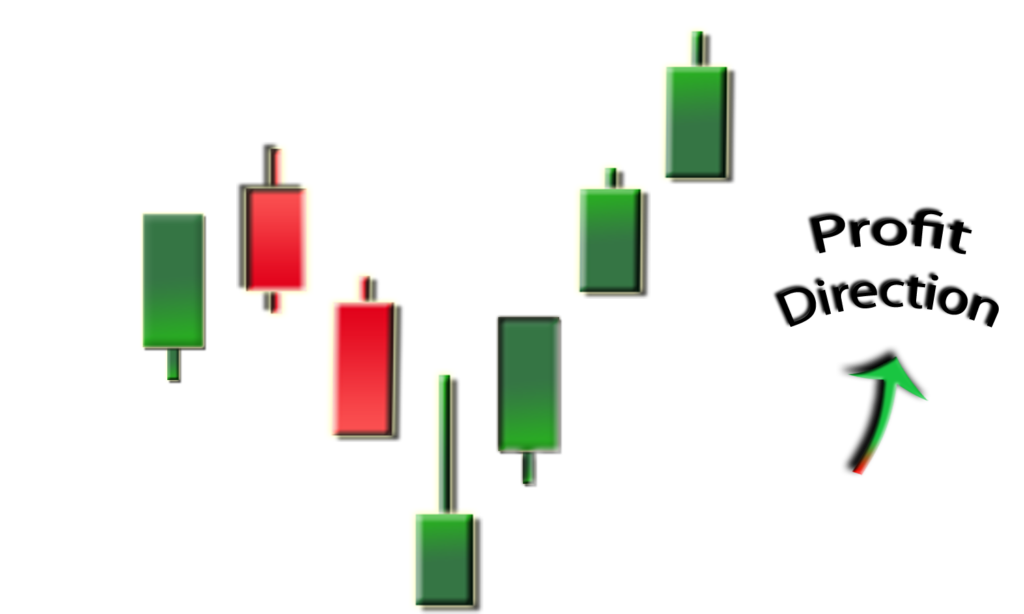

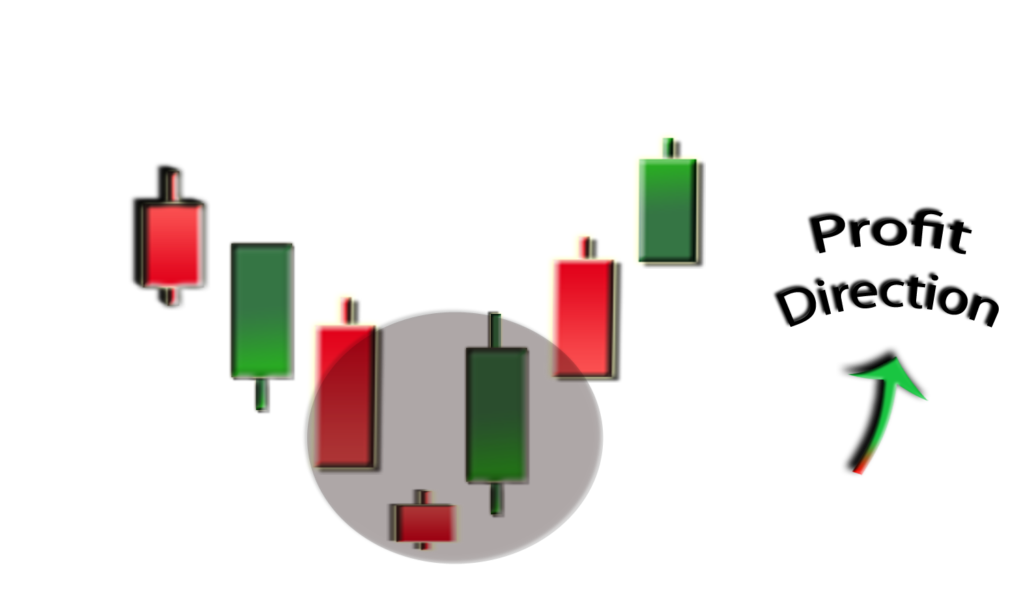

Bullish engulfing

The pattern of bullish engulfing is composed of two candlesticks. A larger green candle entirely engulfs the first candle, which is a short red body.Even though the price starts the second day lower than the first, the bullish market drives it upward, giving purchasers a clear advantage.

Piercing line

A long red candle and a long green candle make up the two-stick design of the piercing line. The opening of the green candlestick and the closing price of the first candlestick typically differ by a sizable amount. The fact that the price has risen to or above the midpoint of the previous day suggests that there is significant purchasing pressure.

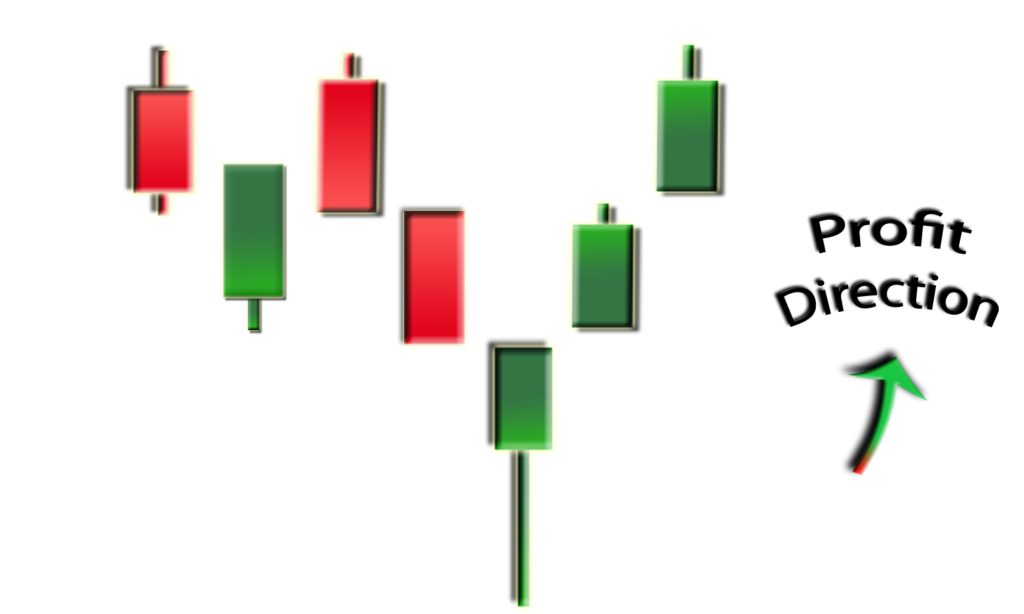

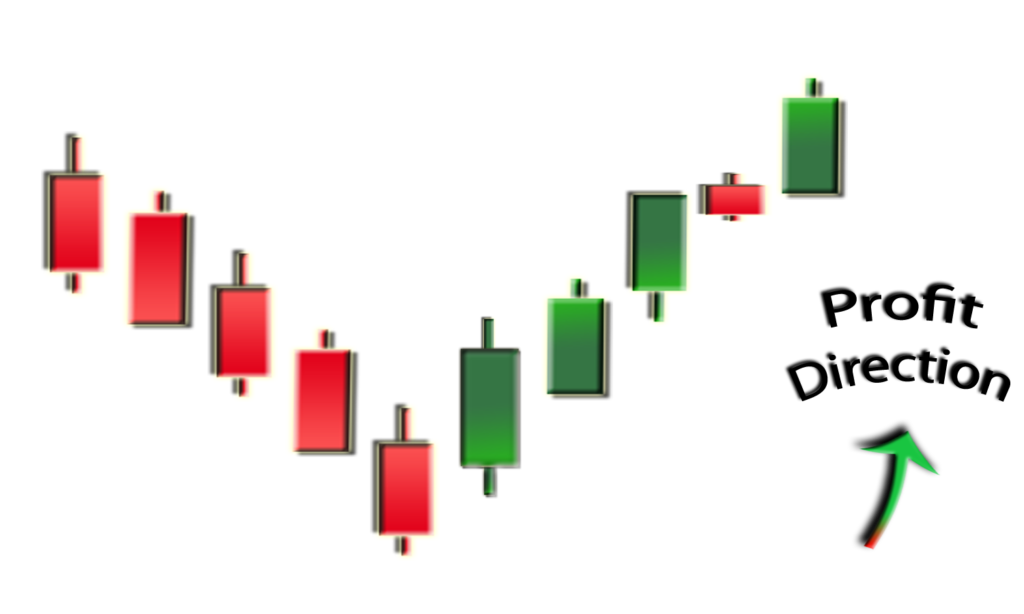

Morning star

In a dismal market decline, the morning star candlestick pattern is regarded as a symbol of hope. One short-bodied candle sits between a long red and a long green stick in a three-stick design. The "star" and the lengthier bodies typically don't overlap because of market gaps that occur at both opening and closing. It indicates that a bull market is approaching and that the selling pressure from the first day is easing.

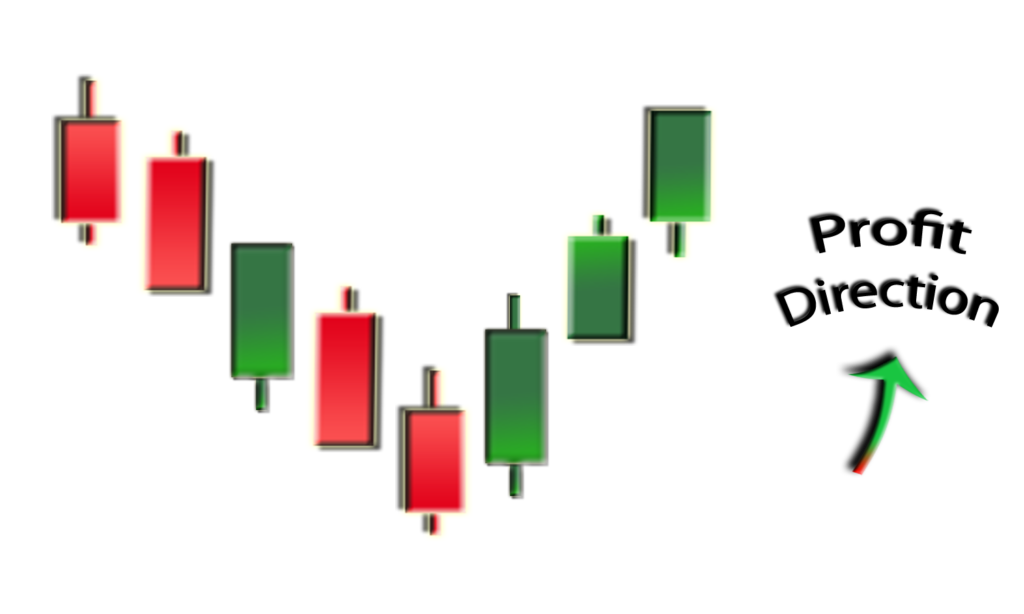

Three Green soldiers

For three days, there is a pattern of three white soldiers. It is made up of a series of long, green candles with tiny wicks that open and close at gradually higher points each day than the one before.

Following a decline, this extremely positive indicator indicates a continuous surge in purchasing pressure.

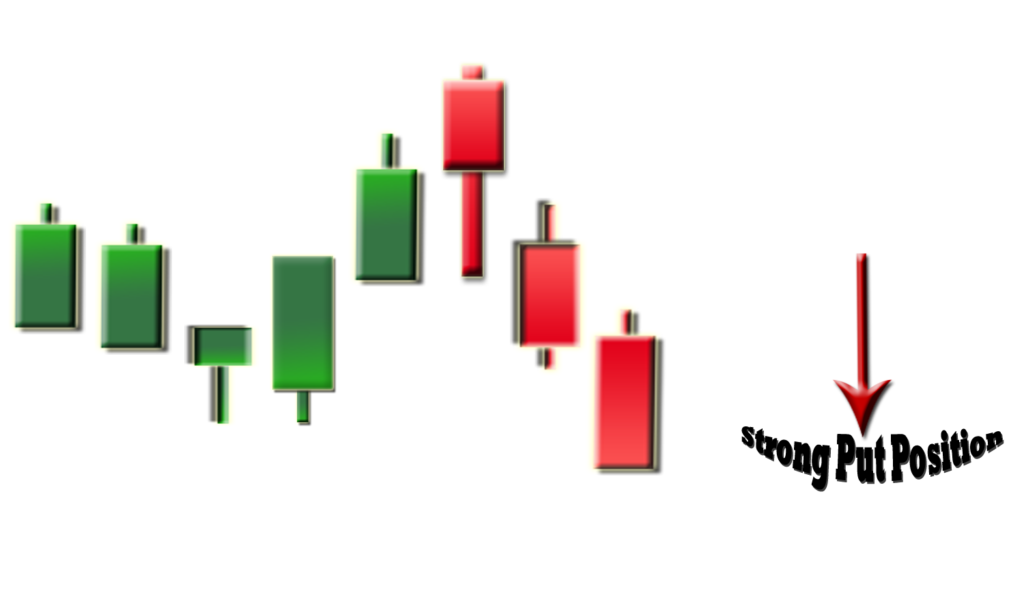

Hanging man

The hanging man, which forms at the end of an upswing, is the bearish equivalent of a hammer. The fact that purchasers were able to drive the price higher again suggests that there was a sizable sell-off during the day. The significant sell-off is frequently interpreted as a sign that the bulls are starting to lose ground in the market.